1 Year Cd Rates Capital One

You can find higher rates elsewhere on both the shorter and longer terms.

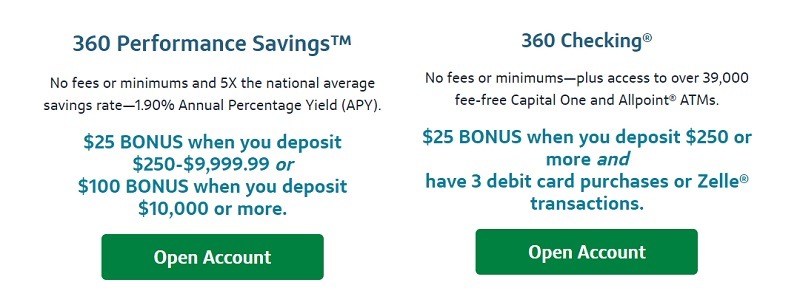

1 year cd rates capital one. As you can see in the accompanying table its rates compete with other high performing banks like ally and marcus by goldman sachs. Capital one offers some of the highest cd rates in the industry. One year cd rates can help boost some of your short term savings. Compared to money market account rates however 1 year cd rates tend to be higher.

Also it is 0 7 lower than the highest rate 2 60 updated feb 2020 on capital one s secure website. Spencer tierney is an expert on certificates of. Learn how you can get locked in rates for your roth ira cd. Capital one cds are among the best but if you want to compare more options check out our list of best cd rates this month.

Capital one 1 year cd rates. Whether capital one has a higher rate than a competitor will depend on the term length. Open an online capital one 360 cd to earn an interest rate with guaranteed yield. How capital one s cds compare to top yielding banks capital one offers below average cd rates.

Though the annual percentage yield isn t as high for capital one s 1 year cd it s worth noting that this choice offers more flexibility than some of the other best 12 month cd rates that are currently on the market. The rate of 1 90 is 0 7 higher than the average 1 2. The rate of 1 90 is 0 7 higher than the average 1 2. In many cases you can qualify for one of the top 12 month cd deals without having to fork over a large amount.

Enjoy the protection of fdic insurance and zero market risk with an online cd account. Also it is 0 7 lower than the highest rate 2 60 updated feb 2020. How capital one 360 cds rates compare to other banks. For example an early withdrawal from a 1 year cd could trigger a penalty equal to three months interest while a 5 year cd withdrawal penalty could equal a whole year s worth of interest.

A 360 ira cd from capital one is a fee free way to save with guaranteed returns for your retirement. With capital one you can choose how you want your interest to be paid out whether it s at the end of the term on a.

:max_bytes(150000):strip_icc()/capital-one-b509f5176c1548e2a3b533611f697776.png)