1 Year Cd Rates Ally

Ally also offers an 11 month no penalty cd and a 2 year and 4 year raise your rate cd that allows you to increase your apy if ally s rates also go up during the term.

1 year cd rates ally. The interest rate for the cd product high yield cd is for a 1 year term which requires no minimum deposit to open. In fact the annual percentage yield apy you get with our 1 year cd rate is consistently among the most competitive in the country. Start with a great rate plus have the opportunity to increase your rate once over the 2 year term or twice over the 4 year term if our rate for your term and balance tier goes up. At ally bank great cd rates are available to anyone.

A 5 year cd while a 5 year cd might have a higher apy a shorter term cd can be a better option. Summary of the best rates available from a large pool of banks here are the best 1 year cd interest rates. Ally s savings rates checking rates bank products are straightforward with no hidden fees. Enjoy 24 7 live customer service the convenience of mobile online banking.

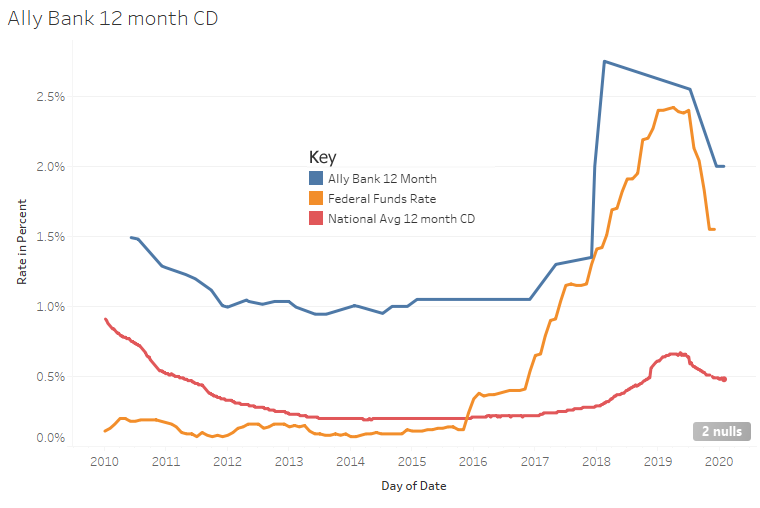

The 5 year will protect against potentially lower interest rates but if rates do go up the 1 year cd frees you up to take more advantage of that. You can open and fund an ally bank cd with any amount and still get a great rate. A great alternative to savings accounts is a 1 year certificate of deposit cd. Also it is 0 1 lower than the highest rate 2 60 updated aug 2019.

It s no surprise then that people often seek another low risk way to get a larger return on their money. Interest compounded daily 10 day best rate guarantee 24 7 service. Ally bank member fdic. Cd rates could change significantly in a year and you might not want to miss out on a.

The current average interest rate on a savings account is just 0 06 according to the fdic. 0 65 apy no. How to build a cd ladder a cd ladder is when you open several cds at the same time each with a different maturity term. The rate of 2 50 is 1 3 higher than the average 1 2.

Alternatives to 1 year cds. Marcus by goldman sachs.